The Complete A-Z Forex Trading Course (Self-Paced Online Edition +3 Interactive Live Sessions Online)

Categories: Forex Trading Beginners course

Course Content

GOOGLE MEET GUIDE FOR ONLINE MEETINGS

This video will show you how to navigate google meet, when you need an online meeting.

-

Google meet guide

01:56 -

Welcome to the Course!

LEVEL 1: FOREX TRADING FOR BEGINNERS

Starting your Forex trading journey? This beginner-friendly module is designed to take you from zero knowledge to confident trader by breaking down the fundamentals of Forex trading in a simple, easy-to-understand way.

🔹 What You’ll Learn:

✅ What is Forex Trading? – Understanding how the market works & key players involved

✅ Forex Pairs & Market Structure – Learn how to trade currency pairs like a pro

✅ Choosing a Forex Broker – How to find a trusted broker in Kenya & internationally

✅ Types of Forex Trading Accounts – Demo vs. Live accounts & how to get started risk-free

💡 Who is This For?

✔ Beginners with no prior experience who want a clear and structured introduction to Forex

✔ Aspiring traders looking to understand how the market works before investing real money

✔ Anyone in Kenya & beyond seeking financial freedom through Forex trading

🚀 Get started today and lay the foundation for a successful Forex trading career!

Module 1:Forex Trading 101: Understanding the Basics & Market Overview

Starting your Forex trading journey? This beginner-friendly module introduces you to the basics of Forex trading in a simple, easy-to-understand way.

🔹 What You’ll Learn:

✅ What is Forex Trading? – Understanding how the market works

✅ Key Players in Forex – Who participates and their roles

-

🔹Introduction to Forex Trading: Everything You Need to Know

-

🔹Introduction to Forex Trading: Lesson Explanation

02:52 -

🔹Who Are the Key Players in the Forex Market?

-

🔹Who Are the Key Players: Lesson explanation

05:25 -

🔹Forex Trading: Key Takeaways

Module 2: Forex Trading Concepts & Terminology: Master the Language of Forex

Understanding Forex trading terminology is the first step to becoming a confident trader. This lesson breaks down essential Forex concepts, market jargon, and key trading terms to help you navigate the market like a pro. Whether you're in Kenya, Africa, or anywhere globally, mastering these terms will improve your ability to analyze charts, execute trades, and communicate with other traders.

🔹 What You’ll Learn:

✅ Key Forex Terms Explained – Pips, spreads, lots, margin, leverage & more

✅ Bid vs. Ask Price – How to read Forex quotes correctly

✅ Lot Sizes & Position Sizing – How to calculate trade volume & manage risk

✅ Understanding Leverage & Margin – How brokers offer leverage & its impact on your trades

✅ Common Forex Trading Slang – Market terms used by pro traders

💡 Why This Matters?

✔ Essential for Beginners – Avoid confusion & trade with confidence

✔ Speeds Up Learning Curve – Helps you grasp Forex strategies & market analysis faster

✔ Improves Communication – Understand professional trader discussions & financial news

🚀 Master these Forex concepts today and take your first step toward profitable trading!

-

🔹What Are CFDs? Definition & Why They Matter in Forex Trading

-

🔹Pips & Points in Forex: Definition & Their Role in Trading

-

🔹Lot Size and position size in Forex Trading: What It Means & Why It’s Important

-

🔹What Is Leverage? Understanding Its Impact in Forex Trading

-

🔹How CFDs, Pips, Points, Lot Size & Leverage Are Connected

05:49 -

🔹Types of Forex Analysis: Why They Matter for Successful Trading

-

🔹Margin & Margin Calls: What They Are & Why Traders Must Know Them

-

🔹Forex Trends: Understanding Bullish & Bearish Markets

01:45 -

🔹What Are Indicators? Their Role in Forex Trading Success

-

🔹Expert Advisors (EAs) in Forex: What They Are & Why They Matter

-

🔹Forex Terminologies: Key Takeaways

Module 3:Forex Brokers Explained: How to Choose the Right One

Choosing the right Forex broker is crucial for every trader’s success. This section provides a comprehensive breakdown of key broker-related topics, ensuring you understand the role, types, and critical factors when selecting a broker.

🔹 What is a Forex Broker? → A Forex broker acts as a bridge between retail traders and the Forex market, facilitating trades by offering liquidity, leverage, and trading platforms.

🔹 Types of Forex Brokers → Learn about Market Makers, ECN (Electronic Communication Network), and STP (Straight Through Processing) brokers, and how they differ in terms of spreads, execution speed, and costs.

🔹 Regulation & Security → Discover why regulatory bodies like FCA, CySEC, and FSCA matter, and how to verify if a broker is legitimate and safe.

🔹 Trading Platforms & Tools → Understand the importance of broker-provided platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, and their impact on execution speed, indicators, and user experience.

🔹 Spreads, Fees & Commissions → A deep dive into fixed vs. variable spreads, commission-based vs. no-commission brokers, and how these affect your trading costs.

🔹 Deposit & Withdrawal Methods → Learn about fast, low-cost, and secure payment options like bank transfers, e-wallets, and cryptocurrencies, and what to watch out for in withdrawal policies.

🔹 Customer Support & Trading Conditions → Why 24/7 customer support, trading execution quality, and additional features like copy trading and VPS hosting can make or break your trading experience.

Why This Section is Important:

A reliable broker ensures fair pricing, fast execution, and fund security. By the end of this section, you’ll have the knowledge to choose a trustworthy broker that aligns with your trading goals and risk tolerance.

-

🔹Who are Forex Brokers? Understanding Their Role in Trading

-

🔹Types of Forex Brokers (ECN, STP, Market Makers, etc.)

-

🔹How Brokers Make Money: Spreads, Commissions, and Fees

-

🔹Regulated vs. Unregulated Brokers: Why It Matters

-

🔹Key Factors to Consider When Selecting a Broker

-

🔹Common Broker Scams & How to Avoid Them

-

🔹Broke Recommendations → Top Forex Brokers

-

🔹Setting Up Your First Forex Trading Account – A Step-by-Step Guide (Video)

03:11 -

🔹Broker: Key Takeaways

Module 4:Understanding Major, Minor, and Exotic Currency Pairs: A Complete Guide for Forex Traders

In Forex trading, currency pairs are categorized into major, minor, and exotic pairs, each with unique characteristics and trading dynamics. Understanding these categories helps traders choose the right pairs based on risk tolerance, market conditions, and strategy. 🚀

-

🔹Currencies, Commodities, and Indices

Module 5:Types of Forex Traders: Scalpers, Day Traders, Swing Traders & Position Traders

What You’ll Learn:

The four main types of forex traders and their trading styles.

How to choose the best trading approach based on time commitment and risk tolerance.

The advantages and challenges of each strategy (scalping, day trading, swing trading, position trading).

Practical insights to help you decide which trading style suits you best.

-

🔹 What is Scalping in Forex? – Understanding Scalpers & Their Trading Style

-

🔹 Who is a Day Trader? – How Day Traders Profit from Short-Term Moves

-

🔹 What is Swing Trading? – Key Strategies & Timeframes for Swing Traders

-

🔹 Who is a Position Trader? – Long-Term Trading & Market Trends

-

🔹 Key Take Aways

Module 6: How to Read a Forex Currency Pair: Base, Quote, and Exchange Rate Explained

📌 What You’ll Learn:

How forex currency pairs work and the difference between base currency & quote currency.

-

🔹 Understanding Currency Pairs in Forex – How Base & Quote Currencies Work

05:24 -

🔹 Key Takeaways: Forex Quotes (Base & Quote)

Module 7: Understanding Currency Correlation: Positive, Negative & Neutral Correlations

📌 What You’ll Learn:

The concept of currency correlation and how different currency pairs move together.

The difference between positive correlation, negative correlation, and neutral correlation.

How to use correlation to reduce risk and diversify trades in your forex portfolio.

Practical ways to apply correlation analysis in trading strategies.

-

📊 Understanding Currency Correlation in Forex – How Pairs Move Together

-

✅ Pros & Cons of Positive Correlation – When It Helps & When It Hurts

-

❌ Pros & Cons of Negative Correlation – Managing Risk with Opposing Pairs

-

📊Pros and Cons of Neutral Correlation in Forex

-

✅Key Takeaways on Correlation in Forex:

Module 8:Mastering Forex Trading Sessions: Asian, London & New York Market Hours

📌 What You’ll Learn:

The four major forex trading sessions (Asian, London, New York, and Sydney).

How market activity changes in each session and which sessions offer the most volatility.

The best times to trade specific currency pairs for maximum profitability.

How to adjust your trading strategy based on session overlaps and liquidity changes.

-

🕰 Introduction to Forex Trading Sessions – Understanding Market Hours & Volatility

-

🌏 The Four Major Forex Trading Sessions – London, New York, Tokyo, Sydney

03:30 -

⚡ Best Trading Hours & Market Overlaps – When Liquidity & Volatility Peak

-

📈 How Different Sessions Affect Currency Pairs – Best Pairs to Trade in Each Session

-

❌ Common Mistakes Traders Make During Sessions – Avoiding Low Liquidity Traps

-

🎯Key Takeaways: Forex Trading Sessions

LEVEL 2: INTERMEDIATE FOREX ANALYSIS

In this intermediate-level course, you’ll deepen your understanding of Forex trading by mastering technical analysis, learning the essentials of fundamental analysis, and becoming proficient with MetaTrader 5 (MT5) on both mobile and desktop. You'll also gain a solid grasp of risk management strategies and the different types of market orders, equipping you with the knowledge needed to trade more effectively and confidently.

🚀 What You Will Achieve:

✅ Advanced Technical Analysis Skills – Learn how to interpret candlestick patterns, identify market trends, and use key indicators like RSI, MACD, Bollinger Bands, and Fibonacci retracements.

✅ Fundamental Analysis Basics – Understand the impact of economic news, interest rates, and geopolitical events on currency prices.

✅ Full Mastery of MetaTrader 5 (MT5) – Learn how to efficiently execute trades, analyze charts, and customize your trading platform on both mobile and desktop.

✅ Risk Management Theory – Discover why risk management is crucial, different risk mitigation strategies, and how to manage leverage effectively.

✅ Understanding Market Orders – Learn about market execution, pending orders, stop-loss, take-profit, and how to use them to maximize your trading efficiency.

✅ Increased Trading Confidence – Develop the skills to analyze the market, place trades effectively, and make informed decisions with minimal risk.

Module 9: Mastering Trading View: Platform Overview & Setup

✅ Understand Trading View’s Interface – Learn how to navigate charts, indicators, and tools efficiently.

✅ Customize Your Trading Workspace – Set up your charts for optimal trading performance.

✅ Utilize Advanced Charting Tools – Leverage drawing tools, timeframes, and technical indicators.

✅ Execute Trades & Manage Alerts – Learn how to place trades, set alerts, and track market movements.

🔹 By the end of this module, you will confidently use TradingView to analyze the markets and make informed trading decisions.

-

🖥️ Introduction to Trading View: Features & Benefits

-

🗺️ Navigating the Trading View Interface Like a Pro

04:21 -

🛠️ Trading Indicators and Templates

04:03 -

🖥️Trading View Tools customization

03:19 -

🔔 Customizing Alerts & Execution of Trades

03:35

Module 10: Deep Dive into Technical Analysis (Trading Strategy 1)

In this module, you’ll build a strong technical analysis foundation by learning how to read and interpret price charts effectively. You’ll be introduced to candlestick patterns, different chart types, support & resistance levels, and key chart patterns that traders use to identify potential market movements. By the end of this module, you’ll be able to analyze price action, recognize trading opportunities, and make data-driven trading decisions with confidence.

🚀 What You Will Achieve:

✅ Understand Candlestick Charts – Learn how to read and interpret candlesticks for market sentiment.

✅ Explore Different Chart Types – Discover line charts, bar charts, and candlestick charts, and their uses.

✅ Master Support & Resistance Levels – Identify key price zones to predict market movements.

✅ Recognize Chart Patterns – Learn common patterns like double tops, head & shoulders, and triangles.

✅ Develop a Basic Technical Strategy – Use your new knowledge to find trade opportunities.

This module sets the foundation for technical trading, helping you spot high-probability trades with ease. 🚀📈

-

📌 Chart Formations

03:00 -

📌 Candlestick Patterns & Chart Formations

08:00 -

📌 Support & Resistance Levels : Trading Strategy

06:55 -

📌 Understanding Market Structure & Price Action patterns

13:53 -

📌Fibonacci Retracement Forex Trading tool.

Module 11: Fundamental Analysis Essentials

In this module, you’ll gain a basic understanding of fundamental analysis and how economic events influence the Forex market. While this course primarily focuses on technical analysis, it’s still important to grasp the role of fundamental factors like news events, interest rates, and economic reports in currency movements. By the end of this module, you’ll know how to interpret major economic indicators and use an economic calendar to avoid trading during high-impact events.

🚀 What You Will Achieve:

✅ Understand the Basics of Fundamental Analysis – Learn how news and global events impact currency prices.

✅ Key Economic Indicators Explained – Get a basic overview of GDP, interest rates, inflation, and employment reports.

✅ How Central Banks Influence the Market – Understand the role of monetary policy in Forex.

✅ Using an Economic Calendar – Learn to identify high-impact news events that may cause volatility.

✅ Why Technical Traders Should Still Be Aware of Fundamentals – Avoid unnecessary risks during news releases.

This module provides a fundamental knowledge base, allowing you to trade more strategically while focusing on technical analysis. 🚀📈

-

📌 What is Fundamental Analysis?

-

📌 Key Economic Indicators (GDP, Interest Rates, NFP, etc.)

-

📌 Using an Economic Calendar for Better Trades

09:57

Module 12: Risk Management & Market Orders

In this module, you’ll learn the importance of risk management in Forex trading and how to use different market orders effectively. Managing risk is crucial for long-term success, as it helps protect your capital and minimize unnecessary losses. You’ll also understand the different types of market orders and how to use them to execute trades efficiently. By the end of this module, you’ll be able to control your risk exposure, set stop-loss and take-profit levels, and place trades with confidence.

🚀 What You Will Achieve:

✅ Understand Why Risk Management is Crucial – Learn how to protect your trading account from unnecessary losses.

✅ How to Use Stop-Loss & Take-Profit Orders – Secure profits and limit potential losses with proper trade planning.

✅ Different Types of Market Orders Explained – Understand market execution, limit orders, stop orders, and how to use them.

✅ Avoid Overleveraging & High-Risk Trading – Learn why excessive leverage can wipe out your account.

✅ Build a Disciplined Trading Mindset – Stick to your risk management rules to trade confidently.

By mastering risk management and market orders, you’ll increase your chances of long-term success and avoid common trading mistakes. 🚀📊

-

📌 Why Risk Management is Crucial for Forex Traders

-

📌 Types of Market Orders (Market Execution, Limit Orders, Stop Orders)

05:29 -

✅ Forex Order Types Cheat Sheet – Simplified

Module 13: Mastering Meta Trader 5 (MT5)

In this module, you’ll learn how to navigate and utilize MetaTrader 5 (MT5), a powerful platform for executing trades and analyzing the forex market. Mastering MT5 will enhance your trading experience by giving you full control over your trades and allowing you to automate strategies for improved performance. By the end of this module, you’ll be able to confidently execute trades, analyze market data, and customize MT5 to suit your trading needs.

🚀 What You Will Achieve:

✅ Master MT5 Navigation – Understand the layout, tools, and features of MetaTrader 5 to navigate the platform seamlessly.

✅ Execute Trades Efficiently – Learn how to place market orders, set stop-losses, and take-profits for efficient trade execution.

✅ Analyze Charts & Indicators – Use advanced charting tools and indicators to identify trends and make informed trading decisions.

✅ Customize Your Platform – Tailor MT5’s interface and features, including alerts and templates, to fit your trading style.

✅ Automate Trading with Expert Advisors – Explore the world of automated trading and backtest strategies to optimize performance.

By mastering MT5, you'll gain the skills needed to trade efficiently, make data-driven decisions, and automate your strategies for success. 🚀

-

📌 MT5 Interface Overview (Laptop & Desktop)

12:54 -

📌 How to insert & remove symbols

01:56 -

📌 Setting Up Indicators & Placing orders

02:40 -

📌 MT5 Interface Overview (Phone)

13:37 -

Practical Assignment

LEVEL 3: FOREX MASTERY PROGRAM

In Level 3: Forex Mastery Program, traders will refine their skills and develop a professional approach to Forex trading. This advanced level is designed to transition participants from intermediate traders to consistently profitable professionals.

Key Achievements:

✅ Practical Risk Management – Master advanced risk control techniques to protect capital and maximize returns.

✅ Trading Strategies – Learn high-level trading strategies used by professional traders to navigate different market conditions.

✅ Trader’s Mindset – Develop the discipline, patience, and psychological resilience needed for long-term success in Forex.

✅ Live Market Application – Apply learned strategies in real-time market scenarios for hands-on experience.

✅ Consistent Profitability – Gain the confidence and skills to trade with consistency and reduced emotional influence.

This program is the final step in achieving Forex trading mastery, ensuring traders have a complete toolkit for sustained success. 🚀💹

Module 14: Step-by-Step Guide to Trading Success (Trading Strategy 2)

✅ Understand the Entire Trading Process – From market analysis to executing and managing trades.

✅ Identify High-Probability Trade Setups – Learn how to spot winning opportunities.

✅ Execute & Manage Trades Like a Pro – Know when to enter, hold, or exit trades.

✅ Avoid Common Trading Mistakes – Develop the discipline needed to minimize losses.

🔹 By completing this module, you’ll have a structured, repeatable approach to trading that increases consistency and profitability.

-

✅ Essential Steps to Mastering the BZRE – (Trading Strategy 2)

-

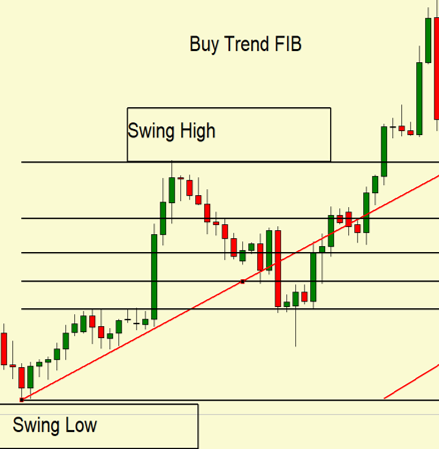

📈 Mastering Swing High & Swing Low: A Practical Guide

04:33 -

📊 How to Identify buy Trends in Forex: Master & Practice

02:10 -

📊 How to Identify sell Trends in Forex: Master & Practice

01:50 -

🔍 Break of Structure Explained – Part 1: Key Insights

-

🧩 Break of Structure – Part 2: Advanced Identification

03:28 -

🖊️ Mastering Drawing Zones: A Practical Approach

03:03 -

📘 Understanding Internal and External Structure

-

📚 BZRE Strategy Masterclass: Learn & Apply

-

🎯 Precision Entry Indicator: Enhancing Trade Execution

06:29 -

📺 BZRE Strategy Trading View Guide: Master Execution

05:57 -

🔥 BZRE Analysis | Key Insights & Market Outlook

12:13 -

📊 BZRE Analysis | Trends & Trade Opportunities

09:10 -

📉 More Practical Analysis for BZRE | Actionable Insights

17:47 -

📉 More Practical improvements for BZRE

08:54 -

📜 BZRE Strategy Rules: A Complete Breakdown

-

🎯 Strategy Cheat sheet

Module 15: Mastering an advanced Fibonacci (Trading Strategy 3)

-

📌Mastering an advanced Fibonacci: Practical Guide

09:06 -

Confluence Fib Strategy

12:11

Module 16: Practical Risk Management: Protect & Grow Your Capital

✅ Master Risk-to-Reward Ratios – Learn how to balance potential gains with acceptable losses.

✅ Apply Position Sizing Techniques – Adjust trade sizes based on risk tolerance and account size.

✅ Use Stop Loss & Take Profit Effectively – Protect your capital while maximizing profits.

✅ Manage Emotions & Avoid Overtrading – Develop the mindset needed for long-term success.

🔹 By completing this module, you’ll have the skills to manage risk effectively and trade sustainably, reducing unnecessary losses.

-

📏 Mastering Position Sizing

02:39 -

⚖️ Understanding Risk vs. Reward in Trading- Part 1

01:46 -

⚖️ Understanding Risk vs. Reward in Trading- Part 2

01:18 -

📆 Developing a Sustainable Risk Management Routine

Module 17 : Ultimate Trading Plan Template: Build Your Strategy

✅ Create a Personalized Trading Plan – Develop a clear roadmap for your trading journey.

✅ Define Entry & Exit Strategies – Establish precise rules for entering and exiting trades.

✅ Set Realistic Profit & Risk Targets – Align your trading goals with effective risk management.

✅ Track & Improve Performance – Learn how to journal trades and refine your strategy over time.

🔹 By the end of this module, you’ll have a well-structured trading plan that guides your decisions and helps you trade with confidence.

-

🧭 Why Every Trader Needs a Trading Plan

-

🔎 Defining Your Trading plan

-

📒 Journaling Trades for Continuous Improvement

LEVEL 4 : TRADING PSYCHOLOGY & MINDSET MASTERY

In this module, traders will develop the mental strength, discipline, and emotional resilience needed to thrive in the Forex market. Trading success isn't just about strategies—it’s about mastering your mindset to stay consistent, confident, and in control under all market conditions.

🔹 KEY ACHIEVEMENTS:

✅ Think Like a Pro Trader – Develop the mindset of top-performing traders.

✅ Master Emotional Control – Overcome fear, greed, and impulsive decisions.

✅ Stay Disciplined & Patient – Learn to follow your strategy without emotional interference.

✅ Handle Losses & Setbacks – Build resilience and recover from trading challenges.

✅ Develop Consistency & Confidence – Improve decision-making and stay committed to long-term success.

✅ Create a Winning Trader’s Routine – Establish daily habits that support peak trading performance.

🔹 By the end of this module, you’ll have the psychological edge needed to trade with clarity, confidence, and consistency. 🚀🔥

Module 18: Understanding Trader Psychology

will delve into the mental and emotional aspects that influence trading decisions. It aims to help traders recognize and manage psychological factors like fear, greed, and overconfidence, which can lead to poor decision-making and losses. By understanding these psychological triggers, traders will learn strategies to stay disciplined, maintain a clear mindset, and make more informed, rational decisions to improve their overall trading performance.

-

📌 What is trader psychology?

-

📌 The role of emotions in trading decisions (fear, greed, hope, overconfidence).

-

📌Practical ways to control emotions in forex trading

Module 19: Handling Losses & Overcoming Psychological Barriers

will focus on developing strategies for dealing with trading losses and overcoming the psychological challenges they present. Traders will learn how to view losses as part of the learning process, rather than failures, and how to maintain a healthy mindset when faced with setbacks.

-

📌 Strategies for bouncing back from a losing streak.

Module 20: Risk Management and Psychology

Risk Management and Psychology" will explore the critical connection between effective risk management and maintaining a sound trading psychology. Traders will learn how managing risk properly can reduce emotional stress and help prevent impulsive decisions. The module will cover techniques to assess and control risk in a way that aligns with personal psychology, ensuring traders can stay calm and confident during both gains and losses. By understanding how psychology influences risk-taking behavior, traders will be better equipped to protect their capital and make more rational, strategic decisions.

-

📌 The relationship between risk management and mental stability.

🎉 Congratulations! You’ve Completed Your Forex Trading Journey!

-

📌 Congratualtions